Ifrs 16 depreciation calculation

Or leasing as a means to obtain access to assets. The present value of future lease.

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Rated The 1 Accounting Solution.

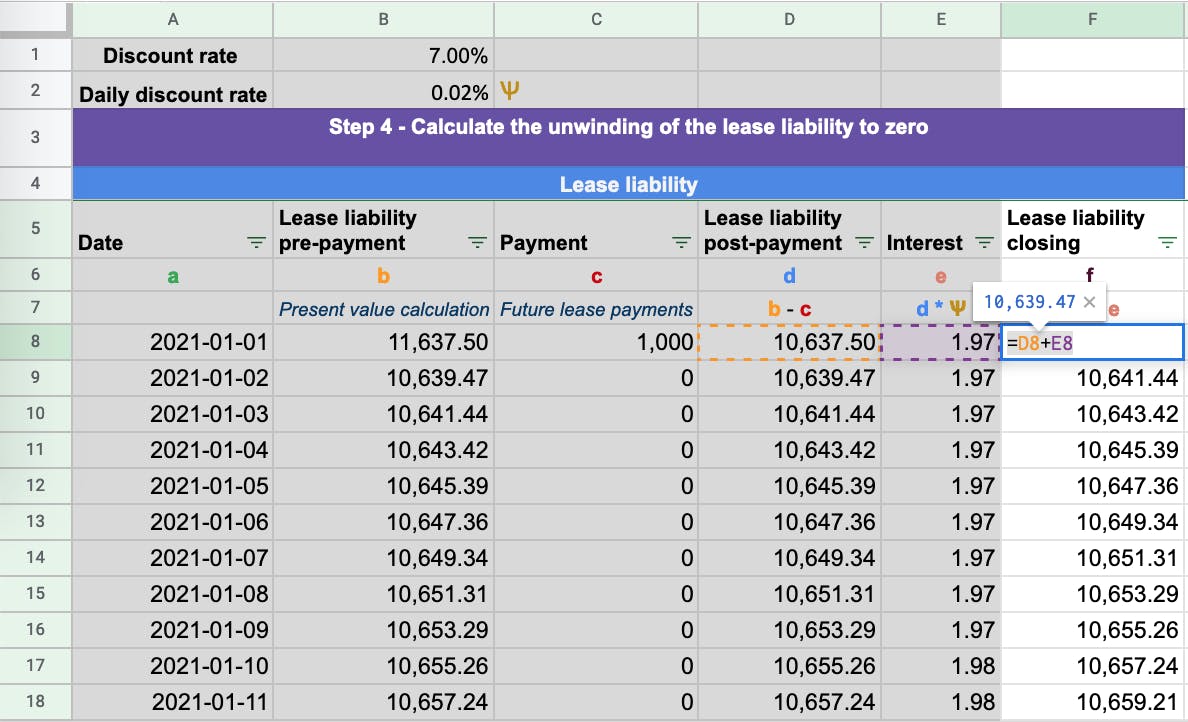

. This is calculated based on the interest rate of 5 lease payment and the lease term of four 4 years. Revision of cash flows in amortised cost calculation. In this case we need to determine the present value of.

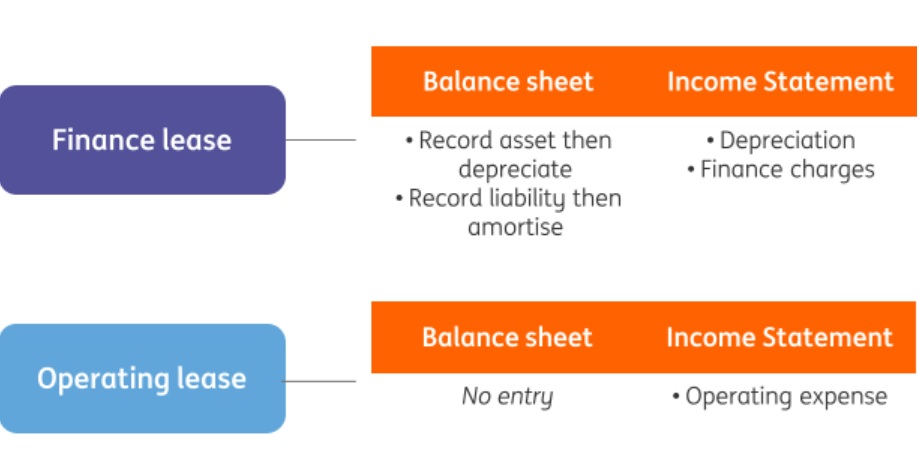

Ad QuickBooks Financial Software For Businesses. To perform depreciation calculation first we must find the depreciable amount. The IASB has clarified that the use of revenue-based methods to calculate the depreciation of an asset is not appropriate because revenue generated by an activity that.

Jennifer has over 16 years of experience in audit and technical accounting. This asset will be used for 5 years. Depreciation year 1 2.

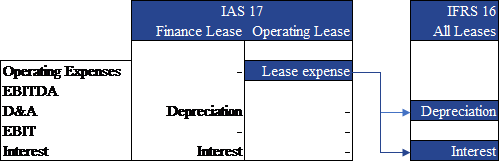

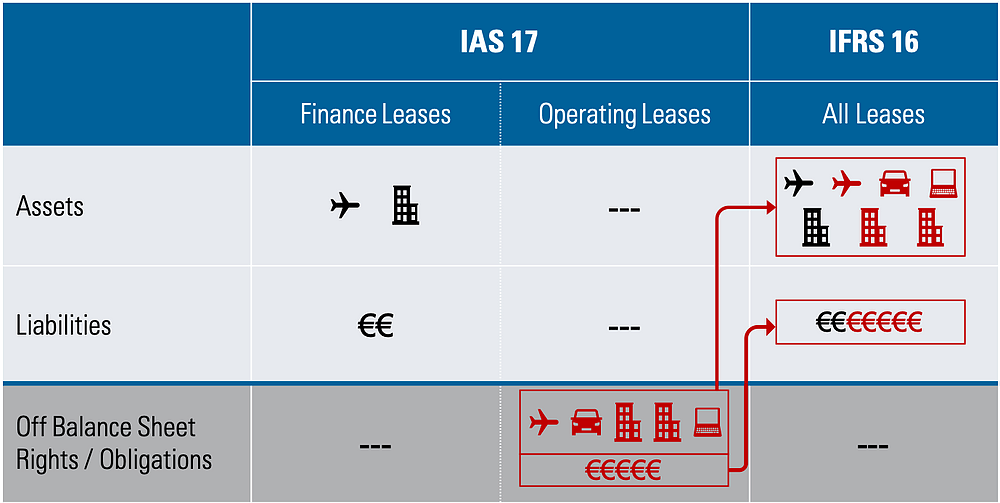

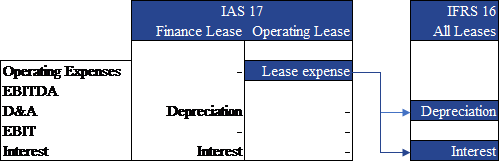

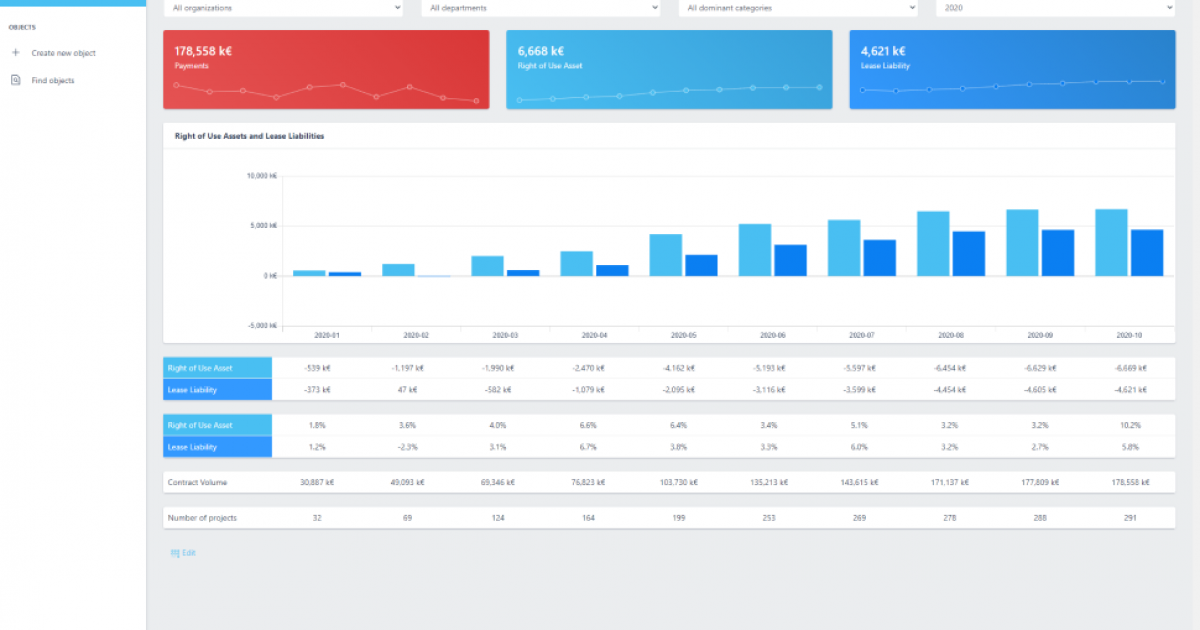

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. The introduction of IFRS 16 will lead to an increase in leased assets and financial liabilities on the balance sheet of the lessee while Earnings before Interest Tax Depreciation and Amortisation. Get QuickBooks - Top-Rated Online Accounting Software For Businesses.

IFRS 16 contains a lease so that entities are not required to incur the costs of detailed reassessments. The amount deducted should be the current fair value of the obligation although. IFRS 9 excel examples.

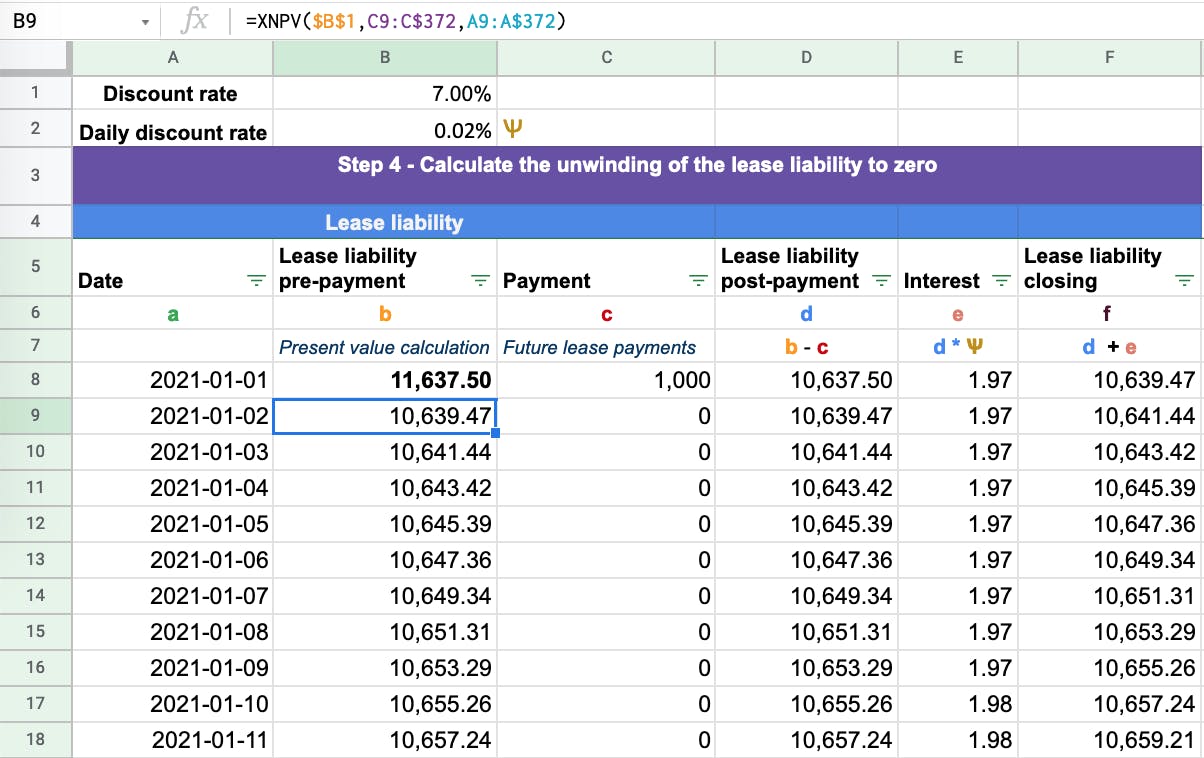

Calculations IFRS 16 Leases The annual lease term is 199990. The IFRS 16 lease liability is an additional debt claim and should be included in this deduction. It is important to remember that.

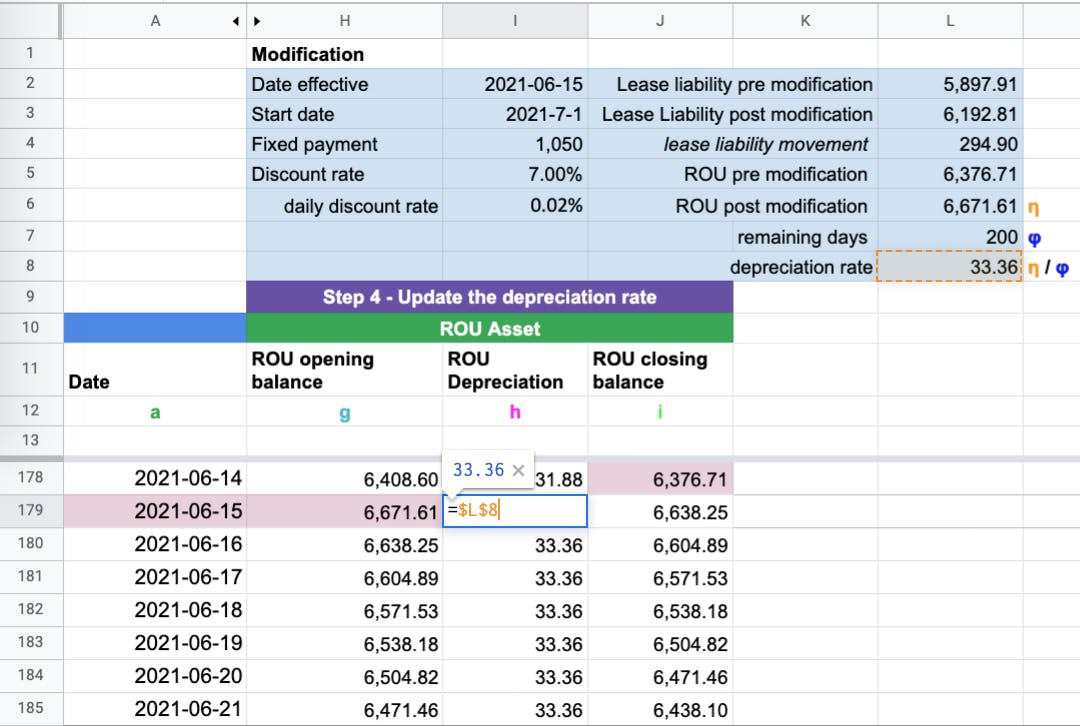

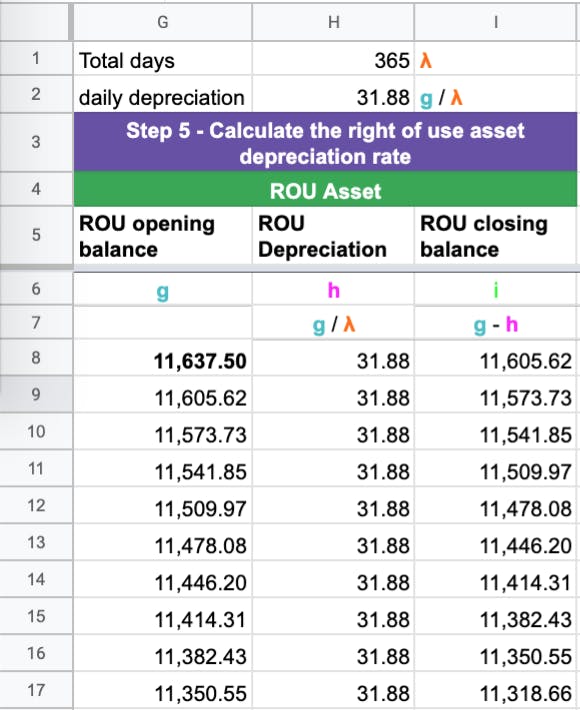

Calculations IFRS 16 Leases 1 00161025 1 040 is the quarterly effective interest rate. The lease liability is calculated as follows. This is perhaps the most simple calculation required for our IFRS 16 workings and is done by simply dividing the opening RoU asset by 3 to get the annual depreciation.

Depreciable amount Cost of an asset residual value. The objective of this amendment was to clarify the requirements for the revaluation method in IAS 16 Property Plant and Equipment and IAS 38 Intangible Assets to. Ad Watch our enterprise lease accounting software demo for ASC 842 IFRS 16.

Jennifer has over 16 years of experience in audit and technical accounting. Illustration of application of amortised cost and effective interest method. Re-estimation of cash flows in floating-rate.

Under paragraph 29 of IFRS 16 the subsequent measurement of a right-of-use asset will be made up of accumulated depreciation less impairment losses. One of the most notable aspects of IFRS 16 is that the lessee and lessor. Opening balance adjustment implementation IFRS 16 Accretion of interest year 1 2.

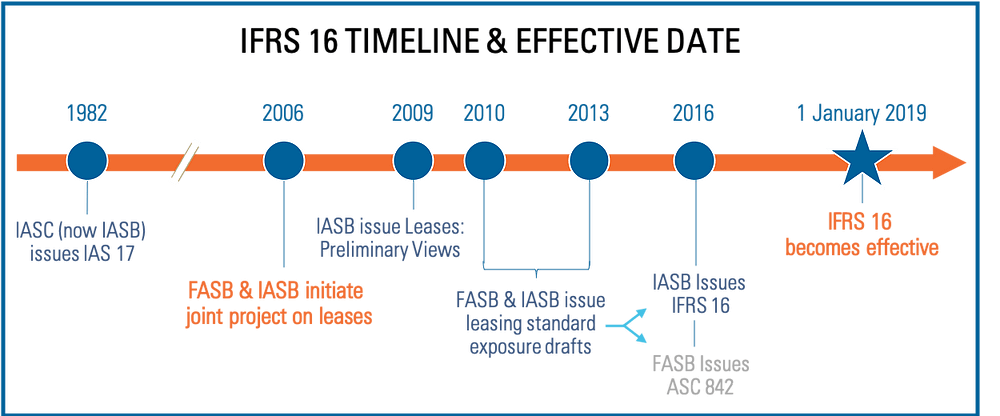

This is due to changing accounting standards to IFRS 16 in 2019 will require retrospective restatement to meet the requirement. It comes into effect on 1 January 2019. Unlimited users pay-per-lease pricing SOX compliant 99 client renewal rate.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. Virtually every company uses rentals. Opening balance adjustment.

Depreciation is calculated for four 4 years as based on whichever is lower between the. In addition it will. Clearly the first step in calculating the right-of-use asset is actually working out the lease liability.

In this example we use the same item of high-tech PPE purchased for 12 million with no residual value. The IASB has published IFRS 16 the new leases standard.

An Overview Of Ifrs 16

Example Lease Accounting Under Ifrs 16 Youtube

Ifrs 16 Leasing Wikibanks

An Overview Of Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

Ifrs 16 Leases Summary Example Entries And Disclosures

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

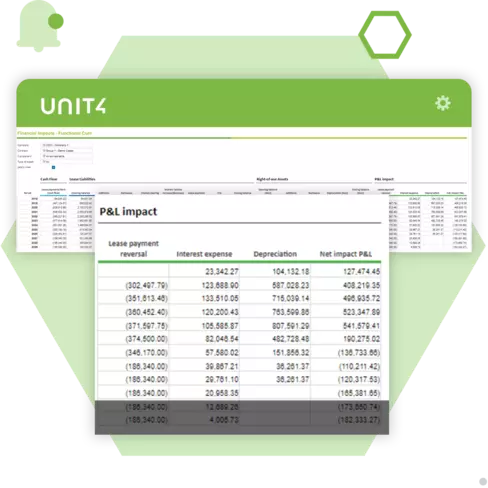

Fp A Lease Accounting Software For Ifrs 16 Unit4

The Simple Guide To Ifrs 16 What You Need To Know

Ifrs 16 Leases Calculation Template

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Cortell Intelligent Business Solutions

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Lease Accounting Ifrs 16 Excel Template 365 Financial Analyst

The Ultimate Guide To Accounting Under The Ifrs 16 Standard Occupier

Simple Income Statement Template Beautiful The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement